- #J welles wilder technical indicators for free#

- #J welles wilder technical indicators how to#

- #J welles wilder technical indicators plus#

#J welles wilder technical indicators for free#

You can get one for free with up to 250 API requests a month. N ote that you need to sign up to financialmodelingprep in order to get your private API key. I will use financialmodelingprep to get the stock prices. To do that, we need first to request from an API the last 5 years historical prices of Apple. We will start by calculating the RSI indicator for each of the 5 historical years. Then, based on the RSI indicator and the stock closing prices of the day, we will define if we go long or if we do not hold any position on that stock for each of the days. To do this, we will calculate the RSI indicator using the 14 days moving average (To know more on moving averages in Python have a look at my previous post). We will use the last 5 years of Apple stock prices.Īs already mentioned before, we will enter a long position if the stock crosses the level 30 RSI indicator from below. Our momentum strategy to backtest will be quite easy to build. Welles Wilder, we will use a length of 14 periods to calculate the indicator.īacktesting RSI Momentum Strategies using Python Since I am not a big fan of going short, we will keep our strategy to only enter long positions.Īs it was suggested by the RSI developer, J.

That is, if the RSI on the stock crosses the level 70 from above, we should enter into a short position. On the other side, when the RSI indicator on a stock goes above 70, the stock is considered to be overbought. At that point, the stock is seen as oversold. To set up a trading strategy following RSI, it is common to open a long position (buy the stock) if the RSI indicator goes above the level 30 from below. The Relative Strength Index (RSI) is a technical indicator that measures the speed and change of price movements. This indicator is the one that we will use in order to define our backtesting strategy with Python. One of this type of indicators is the Relative Strength Index (RSI). Momentum indicators can help us locate the entry and exit points to follow momentum strategies. For example, if the market is or starts going up, we will bet that the trend will continue for a while and we will try to make our trading strategy based on this. What is a Momentum Strategy?Ī momentum strategy basically bets on the continuation of an existing market trend. In addition, the content of this blog may not be free of errors. Note that the content in is only for education purposes, and therefore, it should not be used for trading or investing decisions. This strategy will be exactly the opposite to the mean reversion strategy that we backtested in my previous post using Python.

#J welles wilder technical indicators how to#

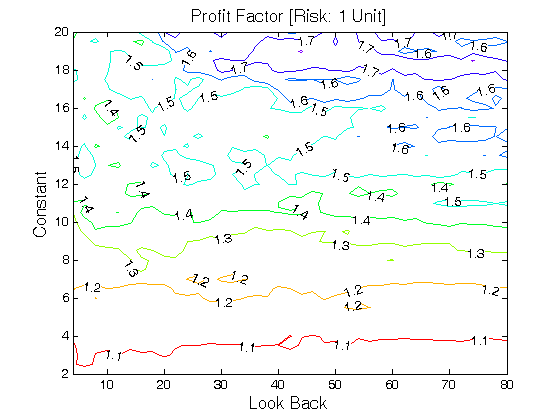

Market cap, ROE, ROA and Forward PE for U.S.During this article, we are going to learn how to backtest RSI momentum strategies using Python.Technical Analysis Continuation Pattern: Ascending Triangle Indicator.Commitments of Traders - Historical Data.VMACD Indicator (Volume Moving Average Convergence Divergence).Advancing-Declining-Unchanged volume for NYSE, AMEX and NASDAQ.Double / Triple Smoothened EMA with Flexible Alpha.Industry Rotation Strategy - iShares ETF Dow Jones Stocks.If you can't run it for example or if it contains errors The Wilders Volatility Index can be downloaded here Wilder Volatility Index - Average True Range This indicator is almost the same as the ATR the difference is that it allows you to specify a constant parameter that is used to increase or decrease the weight of previous True Range values. You can also use a technical analysis indicator called Wilders Volatility Index instead of the Average True Range. The trading system uses the Average True Range (ATR).

The position is closed when it is currently shorted and a long signal is generated or when it is bought and a short signal is generated. A trade is automatically closed when a reverse order is found. The strategy doesn't contain sell or cover trading rules.

#J welles wilder technical indicators plus#

The bearish signal occurs when the above formula (Minus sign is used instead of the Plus sign in the short signal) crosses above the close price. The bullish signal occurs when the close price crosses above the following indicator: Previous value of the lowest close price for the last 7 trading days plus the previous value of the Average True Range using a 7-bar period multiplied by three. The trading strategy is a long/short system that buys a stock or a security when a bull/long signal is generated, then exits and shorts the security when a bearish/short signal is generated.

Welles Wilder in the "New Concepts in Technical Trading Systems" book. The Wilder Volatility Index Trading System is a strategy introduced and developed by J.

0 kommentar(er)

0 kommentar(er)